SHEIN, a popular fashion retailing company, has reportedly begun the process of going public in the US. While much of the information surrounding its transition is currently unknown or confidential, a Reuters report has indicated that the company will likely initiate the transition sometime in 2024.

To understand the circumstances of the move, it helps to understand the concept of an IPO. An initial public offering (IPO) is the process by which a private corporation becomes a public one by allowing the public to purchase its stock shares for the first time. In contrast to this model, private corporations are often funded by a comparatively small amount of investors. Usually, the company’s founders, people close to them, or wealthy professional investors fund the growth of a private company in its early stages. On the other hand, a public company can be invested in by any investor on the public market.

Starting an IPO usually indicates a company’s intention to expand, as allowing a high volume of public investors to buy shares raises a significant amount of money. That money is most likely to be used on improving or scaling up the company’s services and manufacturing. As a result, an IPO can help create new jobs as well as circulate money through the economy as the company can assume new expansionary costs. In this way, Shein’s IPO is likely to benefit the economy in the same way any other IPO would if the company proceeds.

That being said, Shein is already an established and successful company and has found itself a popular choice among many shoppers thanks to its extremely low prices and widely varied merchandise. The company was valued at over $60 billion in May of this year and has been estimated to control about a fifth of the entire market for fast-fashion retailers, reflecting its popularity with consumers and ability to compete with many well-known companies such as H&M, ASOS, and Forever 21. This puts Shein in a position where it may be able to succeed as a public company in the US while also being major competition to other clothing retailers.

However, Shein has also long been a subject of controversy. Many have criticized the company for overproducing clothing as part of the fast-fashion business model, with the sheer amount of different clothing designs and styles the company puts out each year being cited as evidence of the company’s possible contribution to pollution and overflowing landfills. It has also been alleged that some manufacturers working with Shein have used subcontractors that provide poor working conditions to their employees.

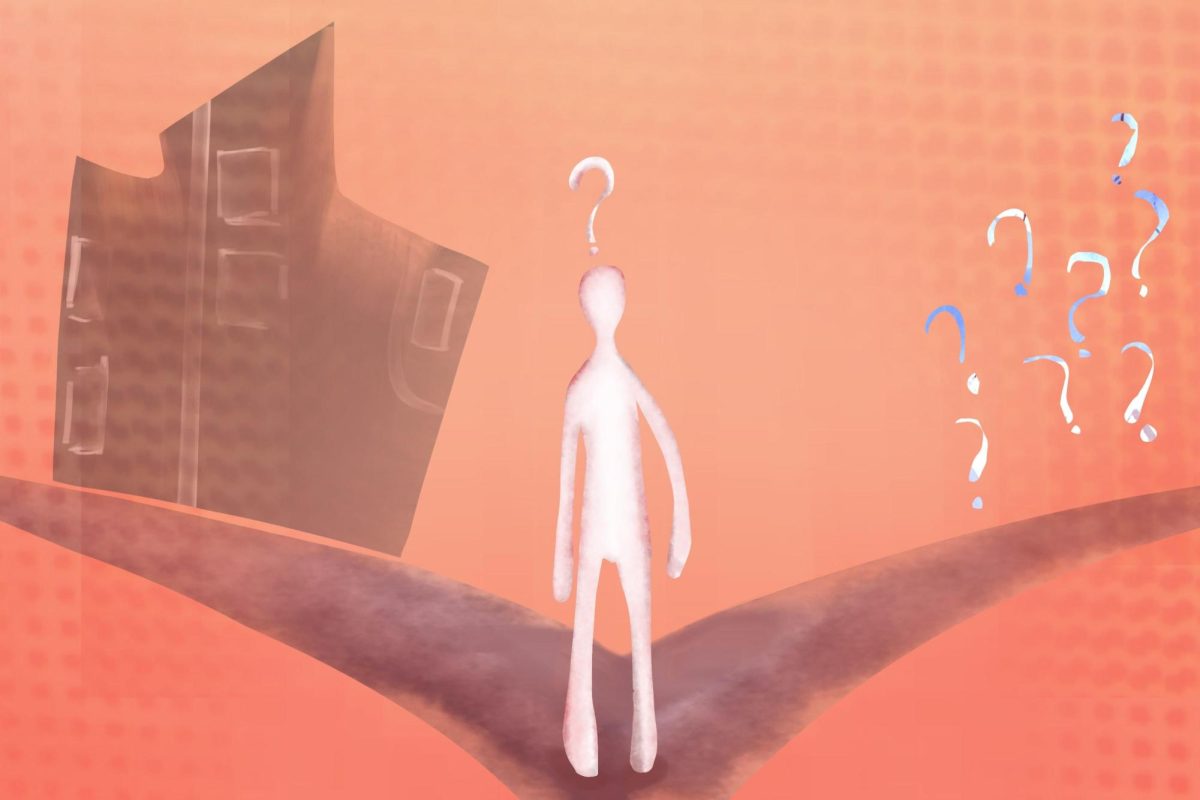

While it appears that Shein’s growth has not been significantly stunted so far by its controversial reputation, its plan for an IPO may be affected. There have been calls for the US Securities and Exchange Commission (SEC) to closely examine Shein’s use of labor before it can start up an IPO. In addition, because Shein conducts most of its business in China, the China Securities Regulatory Commission (CSRC) will have to approve Shein’s IPO before it can reach the US—another logistical obstacle to its transition.

So long as Shein continues on the fast-fashion business model, shoppers can expect more clothing variety and production in the years following its IPO. However, as the company faces regulatory and public scrutiny amid claims of labor law violations and environmental harm, it remains unclear whether Shein will be able to continue to fulfill consumers’ mounting expectations during its transition.

Sources:

https://www.reuters.com/markets/deals/chinese-fast-fashion-shein-files-us-ipo-wsj-2023-11-27/

https://www.investopedia.com/terms/i/ipo.asp

https://www.businessinsider.com/what-is-shein-billion-dollar-fast-fashion-company-explained-2023-7