Simplifying the GameStop stock surge

GameStop…it’s funny how when you first read that word you thought, I haven’t heard of GameStop in years. GameStop is a retail store that sells video games that has declined in popularity since 2012, and the company has been falling apart ever since. However, in the last week and a half, their stock has been surging in price, creating multiple problems in New York. A quick note for reference-a stock is a form of equity in a company For example, if one share of Google costs 500 dollars, you give google 500 dollars, and become a shareholder. You now own part of the company.

Now you might be wondering, if GameStop is struggling so much, how come the stock price is going up? Reddit has been a very popular networking source in the past few years, and investors/day traders from all around the world joined a subreddit called, Wallstreetbets. It all started with a man named Keith Gill, who started posting on this subreddit, telling everyone to invest in the GameStop stock. At first no one listened, but Gill increasingly invested more of his money into GameStop (around 53k) and kept posting about his returns every month. Returns refer to the money made from an investment. Let’s say you invest $10k in amazon shares, and the value of all the shares you purchased increased to $20k, that means you made a return of $10k. At this point during the Covid-19 pandemic, people wanted to get rich fast. After seeing Keith’s posts about him tripling his money, the stock surge began.

When people start buying stocks, the stock price increases because there is more demand. The price has to compensate with the amount of shares being bought. For example, if originally 1,000 people bought one share in apple stock which costs 50 dollars per share, nothing changes; but when 5,000 more people buy a share the stock price goes up to 70 dollars. The price has to increase, but if people start selling their shares the stock price will go down, and remaining shareholders will lose money. GameStop prices surged through the roof because people started buying more and more shares by the minute. Last Wednesday, the stock jumped to $483 per share, a record high, before plunging to $194 per share Thursday and then sharply rebounding to end the week. At the start of the year, GameStop shares went for around $18.

How does the price surge of GameStop hurt Wall Street? Hedge fund managers are people who invest in all types of securities. Securities are investments which gain or lose value over time, such as a stock, bond, etf, mutual fund, etc. They shorted investment positions on GameStop, and it did not work in their favor.

To understand how shorting works, take Facebook for example. You see they’re having legal issues, and you decide to bet against the market; you believe the price of the stock will decrease. In order to make this transaction, you have to go to a broker, and the broker has to go find the stock you want to bet against.

The broker finds the stock in his client’s portfolio and borrows it. In order to complete the transaction, you have to set up a margin of safety account, which states that if you lose money, you will have the money to pay back the client and broker. You borrowed 2 shares of Facebook stock, costing you $500 in total, and then you sell those two shares to other investors in the stock market. If the stock price goes up, you lose money, and if it keeps going up you could lose an infinite amount of money. If the stock price goes down, you could possibly triple your money.

In order to make money from a short, you would have to cover your position-meaning, buy back the amount of shares you borrowed. Since, the stock price went down for Facebook from 250 to 200 dollars per share, you made a profit of $100. All you have to do is return the two shares of the stock to the client, pay the interest rate the broker charged you, and keep the remaining profits. Here is how it works, you have 500 dollars in your margin account, because you sold the two shares at $500, now what you are doing is waiting for the stock price to drop. Since, the stock price of one share dropped to $200, you can buy back the two shares you owe the broker’s client at a cheaper price. So you have $500 in cash, and need to only pay $400 for 2 shares of Facebook stock. You buy the two shares, and return the two stocks back to the broker’s client, and keep the $100 you made from the investment.

To simplify this idea of shorting, think about it like this: you go up to someone who is selling lemons, and one lemon costs $1. You ask the seller if you can borrow one lemon, promising to pay them back (meaning give them their lemon back). So you take that one lemon, and when for some reason, the price of the lemon goes down to 50 cents, using the 1 dollar you have, you can buy back 2 lemons now from the owner of that lemon shop. You give back the one lemon to the owner, and you have one lemon for yourself. You have made a profit of 50 cents.

In this case, GameStop stock surged, and hedge fund managers who shorted the stock were losing money rapidly. Thus, they had to cover their positions even quicker, meaning buy the stocks back. As a result, hedge fund managers and other investors who shorted gamestop lost a lot of money. This made Wall Street angry because they did not want to lose money over some reddit chat.

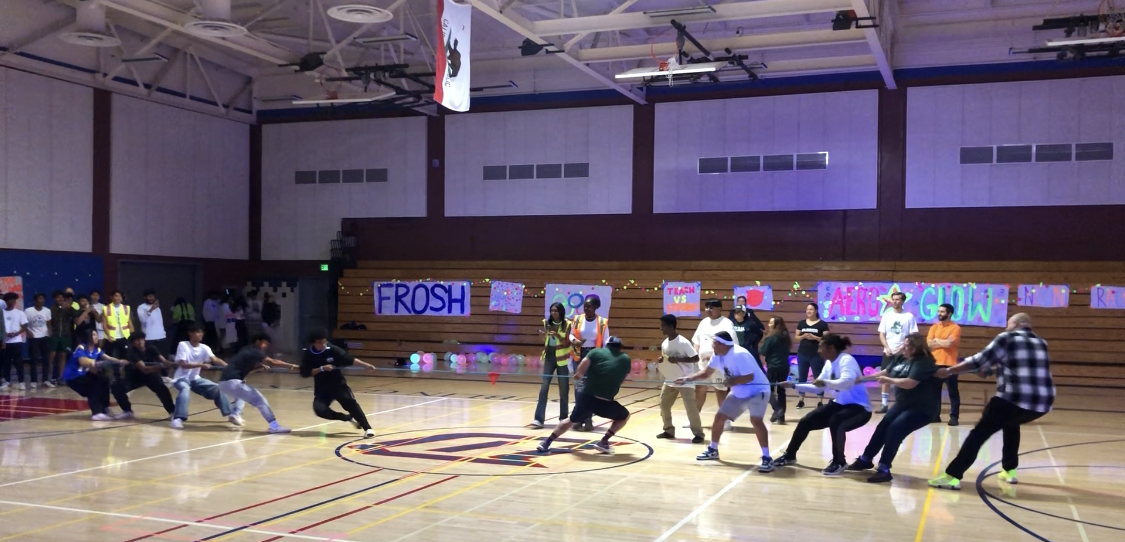

Two DHS students who invested in the GameStop stock, had some words to share. Darion Phan, senior at DHS, said “I think the recent GameStop stock surge is great for regular Americans and horrible for Wall Street. Much to the disappointment, confusion, and eventual indifference of my parents, I bought around half a share when the price of a stock was near $325, but I would buy more if Robinhood’s possibly illegal policy on GameStop allowed me to. Who doesn’t want to make money AND be on the right side of history?” Senior Chinmay Varshneya said “the valuation is obviously detached from reality, and I fear that lots of people who invested over the last couple of days will get burnt”.

In the last two days, the GameStop stock dropped in price from reaching a high of $480, to now selling at $53 per share now. This has to do with Robinhood limiting people from buying shares in GameStop. Without people buying shares, the price keeps going down, and forces more people to sell their shares in the stock. At this very moment, the GameStop price surge seems to be dead.

In conclusion, when you invest in a bubble, invest early not later.

Your donation will support the student journalists of Dublin High School. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.

Logan Lin, a junior at Dublin high school, plays guitar, and has played both JV baseball and football during the first two years of his high school career....

![[Book Review] Weapons of Math Destruction: The insidious danger of Big Data](https://thedublinshield.com/wp-content/uploads/2024/06/wmdsarticle-727x1200.jpg)