Tax Returns – Turns out the President Has Been Paying

One of several controversial issues of the 2016 presidential election was the refusal of then Republican presidential nominee, Donald Trump, to release his tax returns, breaking several decades of tradition and causing great speculation as to their contents. Though partial documents were leaked to the press, the complete tax returns are yet to be released, and judging by comments from the White House, are unlikely to ever be. It appears that one of the accusations, that President Donald Trump avoided paying taxes for more than two decades may not have been accurate after all.

A White House official remarked this past Tuesday that President Trump had paid $38 million on more than $150 million in income in 2005 hours before the complete figures were revealed on “The Rachel Maddow Show.” The figures were from President Trump’s 1040 tax form from 2005 that was leaked to David Cay Johnston, who then brought the documents to Maddow. Freshman Shruti Vera mentioned that she was “concerned that the source of presidential information seems to be coming from leaks rather than directly from the president, as they should.”

It should be noted that the leaks did not reveal the sources of income, which was the primary reason Democrats demanded the president reveal his tax returns. The form did reveal that President Trump paid $38 million in federal taxes in 2005, and brought in just under $153 million in income. That gave Trump a tax rate of 25% when, in 2005, the top marginal federal income tax rate Trump would have qualified to pay was 35%.

The $38 million in taxes included a payment of just over $31 million of alternative minimum tax (AMT), an add-on to federal taxes that are intended to catch high earners whose income falls outside of median incomes. President Trump’s tax payments further included a $1.9 million in self-employment taxes, mostly Medicare and Social Security taxes.

Excluding those two discrepancies, President Trump paid $5.3 million in federal taxes on a $48.6 million adjusted income, after claiming a $103 million business loss that year for an effective federal tax rate of 10.9%. Comparably, the average American resident in 2005 paid an effective federal tax rate of 13.6% on an average adjusted income of $38,754.

However, the tax returns revealed that some claims against President Trump were unfounded. Even though 1995 tax filings suggested that President Trump would be able to legally offset taxes for the next eighteen years, it’s clear that he began playing taxes well before that. The 2005 tax return also notes around $17 million in itemized deductions, which can include charitable donations, though explicit proof of charitable donations would be delineated in a different tax form. As one junior remarked, “It’s clear that he’s paid something, which is a lot more than what I expected.”

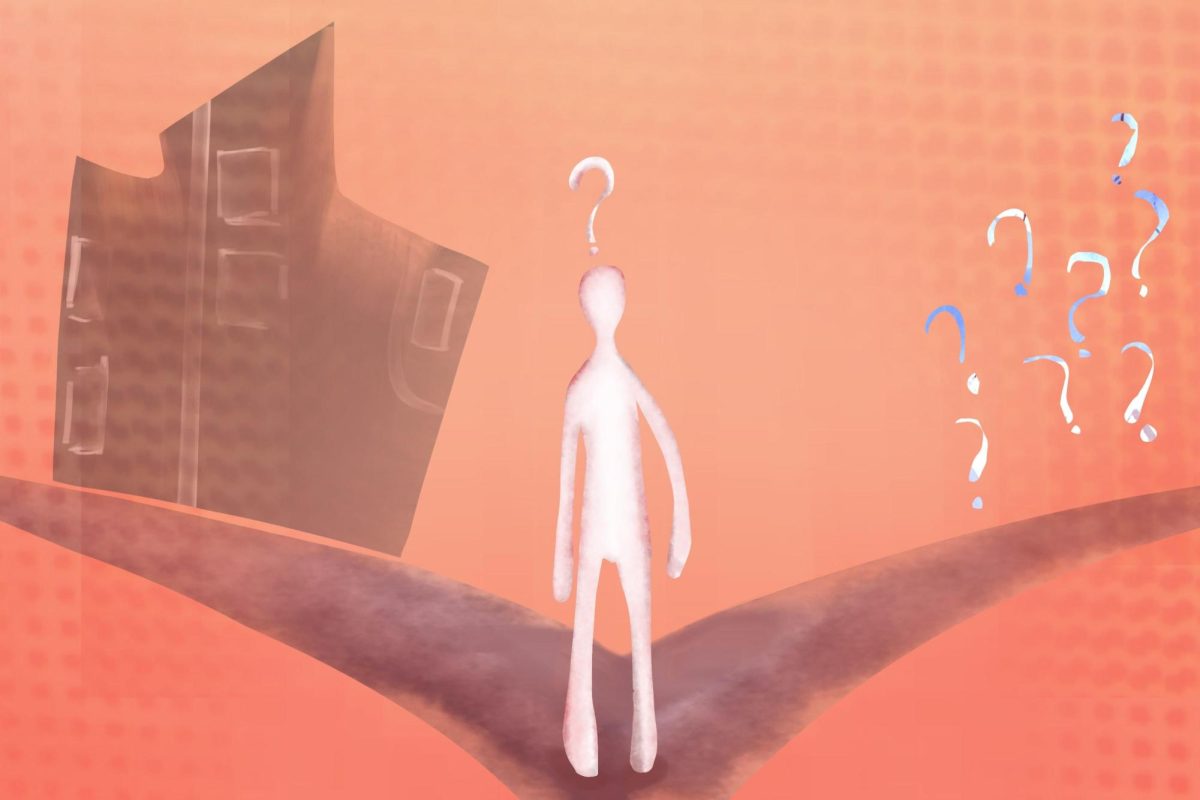

The considerable lack of information from this form motivated Sophomore Ashlee Smith to remark that “if anything these, leaks have proven that there is a need for the President to release his tax returns; until then, everything’s up to speculation.”

Your donation will support the student journalists of Dublin High School. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.

Kaushikee Nayudu is a senior at Dublin High and the Editor-in-Chief for the Dublin Shield where she enjoys writing articles covering a diverse range of...